Tap to pay vs. scan to pay: why CPOs need both to stay AFIR-ready

Imagine pulling up to an EV charger after a long drive. You just want to plug in, pay, and get going - no apps, no accounts, no hassle. Whether you tap your card or scan a QR code, the experience feels simple. But for CPOs, delivering that experience requires navigating regulations, hardware choices, and backend integrations.

03 December 2025

At a glance

In Europe, the AFIR (Alternative Fuels Infrastructure Regulation) is setting the standard for payment accessibility and transparency at public charging stations. It requires that all public chargers support ad-hoc payment methods, to make sure that any driver, regardless of membership or app, can start charging instantly. Two main solutions have emerged: tap to pay and scan to pay. Both achieve AFIR compliance, but each brings its own benefits, challenges, and strategic implications for CPOs.

AFIR’s goal is simple: make EV charging as easy as refuelling a car. But for CPOs, that means getting the payment infrastructure right, compliant, accessible, and reliable for every driver. This regulation puts a spotlight on payment infrastructure – one of the last major pain points in the EV charging experience. But AFIR doesn’t prescribe how to implement ad-hoc payments. Instead, it leaves room for innovation.

That’s where tap to pay (contactless/NFC) and scan to pay (QR code/web-based) come into play. Both satisfy AFIR requirements, and both cater to different user preferences and operational realities. Together, they form a complete, future-proof payment ecosystem

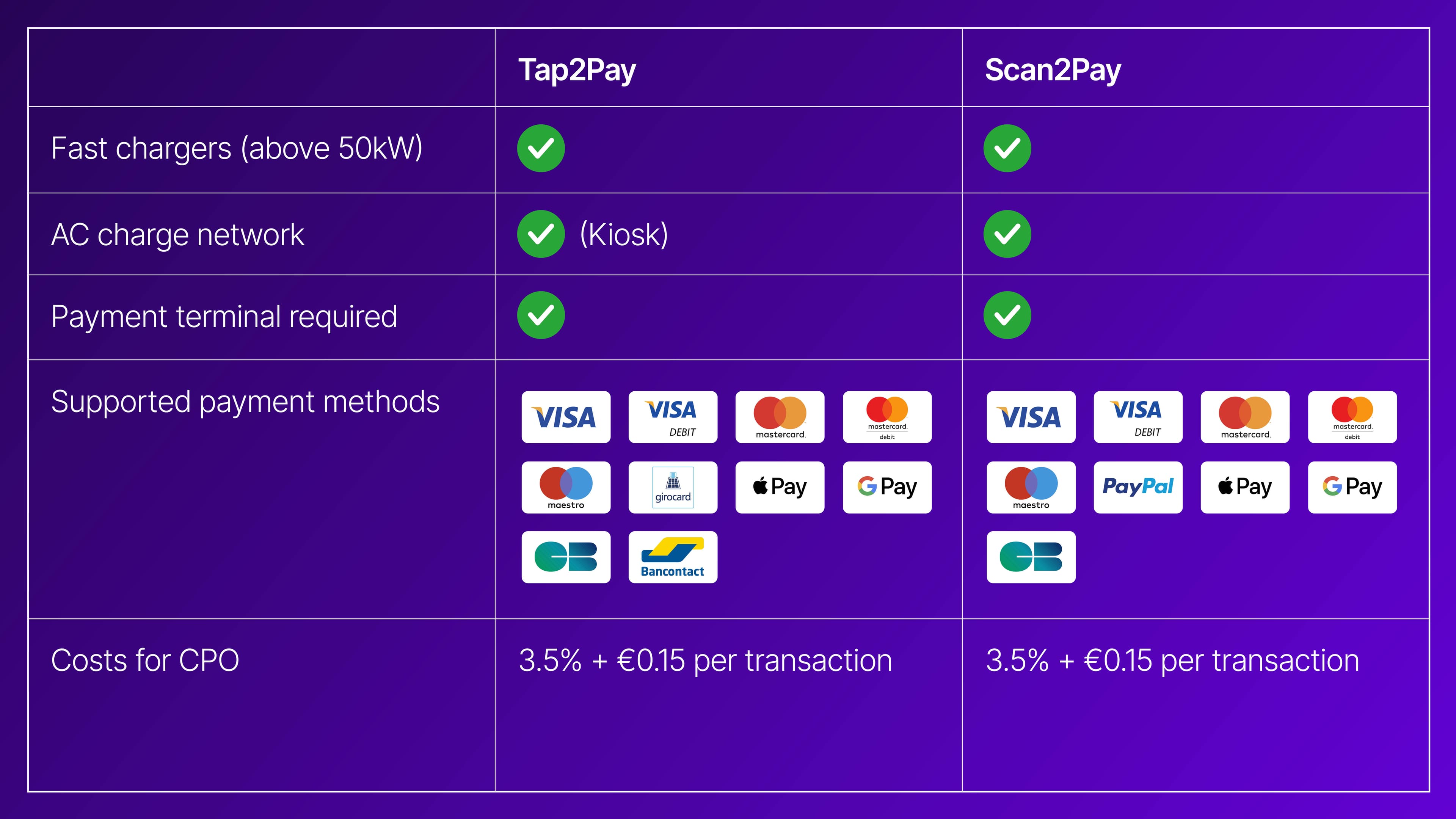

Tap to pay

Tap to pay uses Near Field Communication (NFC) technology - the same standard behind contactless credit cards and mobile wallets such as Apple Pay or Google Pay. The tap to pay option is mandatory for every DC charger. So, every DC charger has to be equipped with a payment terminal, meaning you can always use a payment card at every DC charger. At the charger, drivers can tap their card, phone, or smartwatch on a payment terminal. The terminal communicates with a payment service provider (PSP), which handles transaction authorisation and settlement.

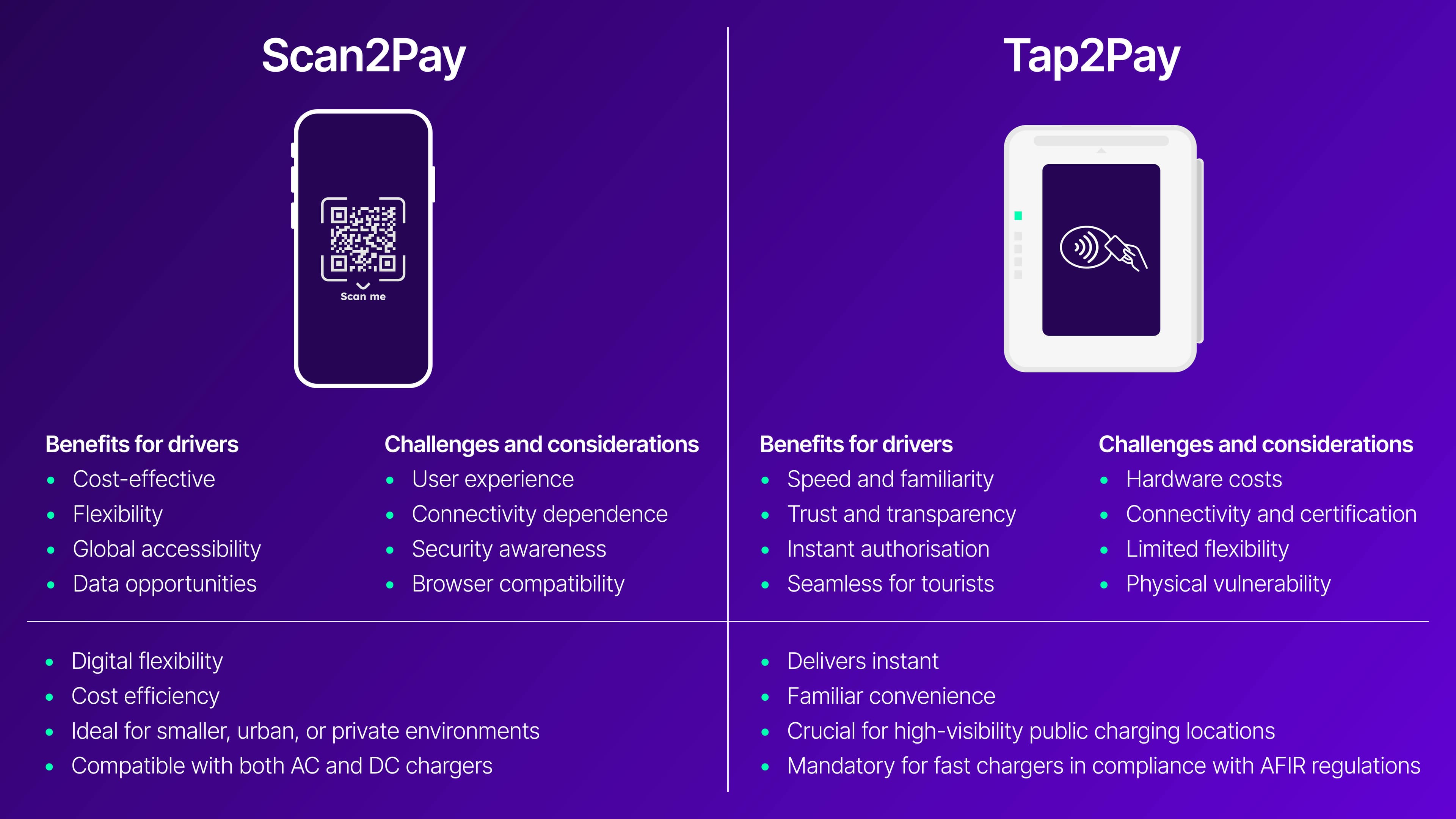

Benefits for drivers

Speed and familiarity: tap to pay offers the quickest, most intuitive experience. Drivers already know how it works from retail, transit, and hospitality.

Trust and transparency: the presence of a physical card reader conveys legitimacy and aligns with expectations of public payment environments.

Instant authorisation: payments are processed in real time, reducing the risk of failed or delayed transactions.

Seamless for tourists: international visitors can use their existing payment cards without language barriers or app downloads.

Challenges and considerations for CPOs

Hardware costs: each charger requires a certified payment terminal, which can increase installation and maintenance costs.

Connectivity and certification: terminals need stable network access and compliance with PCI-DSS standards.

Limited flexibility: NFC-based payments are harder to integrate with digital loyalty systems or dynamic pricing structures.

Physical vulnerability: outdoor terminals face wear, vandalism, and weather-related issues.

Despite these hurdles, tap to pay remains the most intuitive option for quick transactions, making it indispensable for high-traffic sites and highway corridors.

Scan to Pay

Scan to Pay replaces physical payment terminals with QR codes displayed on the charger. Drivers use their smartphone camera to scan the code, which opens a secure web page or app-based interface. There, they can select the connector, start the session, and pay via credit card, debit card, Apple Pay, and Google Pay.

Unlike tap to pay, this model relies on cloud infrastructure - linking the charger to backend systems that manage payments, authorisation, and session data through APIs.

Benefits for drivers

Cost-effective: no physical terminal means lower hardware and maintenance costs. Ideal for smaller or distributed charging sites.

Flexibility: web-based systems can easily add loyalty programs, coupons, or company-branded UX.

Global accessibility: users can pay with local or alternative methods not supported by card terminals.

Data opportunities: CPOs can gather insights on user behavior, charging frequency, and preferences.

Challenges and considerations

User experience: it adds a few extra steps - scan, open browser, confirm - which may feel slower than a tap.

Connectivity dependence: requires both charger and driver to have stable internet access.

Security awareness: some users hesitate to scan QR codes due to phishing concerns. In addition to this, E-Flux by Road offers in-app payments through the app.

Browser compatibility: minor inconsistencies can arise between devices and browsers.

Still, scan to pay is a flexible, scalable option, especially for CPOs expanding rapidly or managing mixed charger portfolios.

Why both options are equally important

While tap to pay and scan to pay approach payment differently, they complement each other perfectly.

From a compliance standpoint, either solution satisfies AFIR, but together they create a truly inclusive system that accommodates all drivers – locals, tourists, app users, and casual visitors alike. CPOs that offer both are better positioned to handle regional differences, technical contingencies, and evolving user expectations. And beyond compliance, offering choice builds trust and brand value, signaling that the operator puts the driver’s experience first.

Tapping and scanning with E-Flux by Road

That’s where E-Flux by Road comes in. We manage the full payment flow on behalf of CPOs, from contactless card transactions to QR based payments ensuring every session is processed, settled, and reimbursed correctly. Our platform connects with all major payment methods, handles VAT compliant invoicing, and guarantees AFIR compliance without added operational complexity. Whether you manage a few chargers or thousands, we take care of the payments so you can focus on uptime and driver experience.

Tap to pay brings simplicity, speed, and familiarity. Scan to pay brings flexibility, scalability, and innovation.

The future of EV charging isn’t about choosing one over the other – it’s about combining both to serve every type of driver, everywhere. For CPOs, supporting both tap to pay and scan to pay isn’t just a compliance box: it’s a driver experience differentiator. A reliable payment process reduces support calls, increases repeat use, and builds trust with fleet and roaming drivers